Introduction

Operation Snapshot

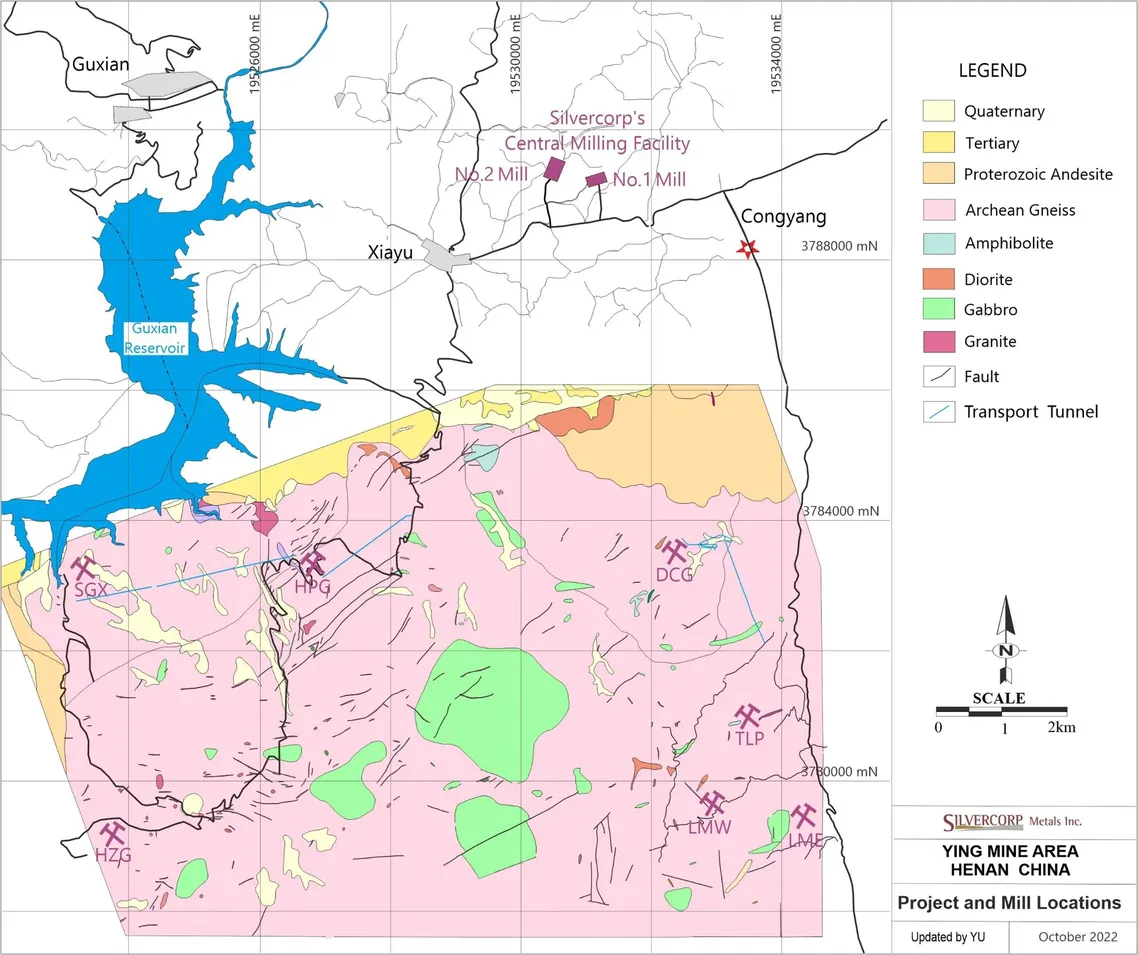

MINES

Mineral Processing

Exploration and Geology

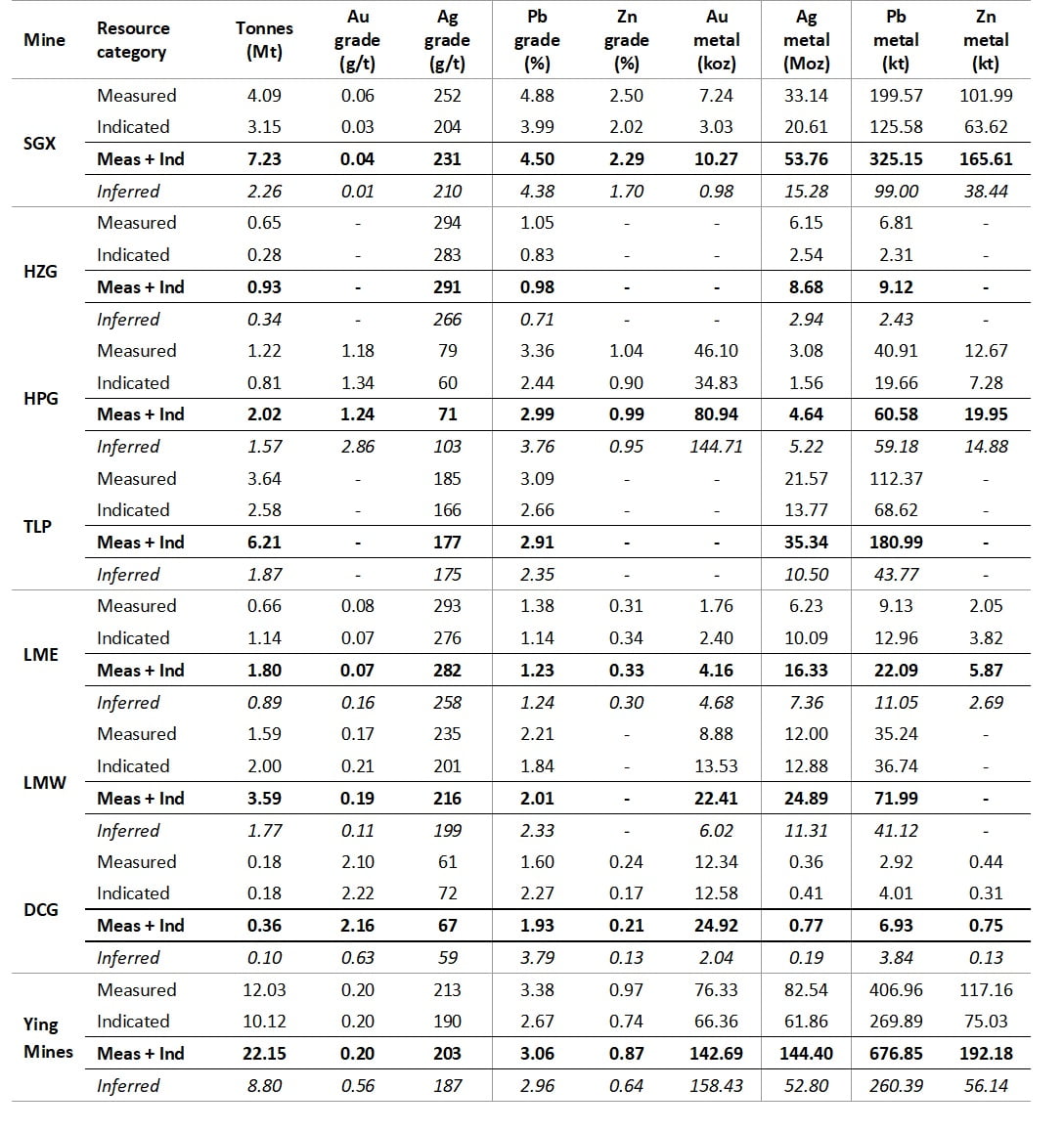

Notes:

- CIM Definition Standards (2014) were used for reporting.

- Measured and Indicated Mineral Resources are inclusive of Mineral Reserves.

- Metal prices: gold US$1,800/troy oz, silver US$21.00/troy oz, lead US$1.00/lb, zinc US$1.10/lb.

- Exchange rate: RMB 7.00: US$1.00.

- Mineral Resources exclude the first 5 m below surface.

- The Mineral Resource estimates for the SGX, TLP, and HZG mines were carried out by Silvercorp and reviewed by independent Qualified Person, Mr Simeon Robinson, P.Geo., MAIG of AMC, who takes responsibility for these estimates.

- The Mineral Resource estimates for the LMW and LME mines were carried out by Silvercorp and reviewed by independent Qualified Person, Mr Justin Glanvill, Pri.Sci.Nat. of AMC, who takes responsibility for these estimates.

- The Mineral Resource estimates for the HPG and DCG mines were carried out by Silvercorp and reviewed by independent Qualified Person, Dr Craig Stewart, P.Geo. of AMC, who takes responsibility for these estimates.

- Veins factored to minimum extraction width of 0.4 m after estimation.

- Cut Off Grades (COGs): SGX 140 g/t AgEq; HZG 130 g/t AgEq; HPG 140 g/t AgEq; TLP 125 g/t AgEq; LME 130 g/t AgEq; LMW 125 g/t AgEq; DCG 150 g/t AgEq.

- AgEq equivalent formulas by mine:

- SGX = Ag g/t+35.05*Pb%+17.97*Zn%.

- HZG = Ag g/t+33.59*Pb%.

- HPG = Ag g/t+80.6*Au g/t+35.17*Pb%+21.60*Zn%.

- TLP = Ag g/t+33.23*Pb%.

- LME = Ag g/t+32.71*Pb%+9.38*Zn%.

- LMW = Ag g/t+34.20*Pb%.

- DCG = Ag g/t+33.18*Pb%.

- AgEq formulas used for significant gold bearing veins:

- SGX (Veins S11, S16W_Au, S18E, S74) = Ag g/t+54.44*Au g/t+35.05*Pb%+17.97*Zn%.

- LME (Veins LM4E2, LM4E3) = Ag g/t+55.12*Au g/t+32.71*Pb%+9.38*Zn%.

- LMW (Veins LM21, LM22, LM26, LM28, LM50, LM50_3, LM52, LM53, LM54) = Ag g/t+71.85*Au g/t+34.2*Pb%.

- DCG (Veins C76, C9_1, C9_2, C9_3, C9_4, C9E1, C9W1) = Ag g/t+83.44*Au g/t+33.18*Pb%

- Includes assay results up to and including 31 December 2023.

- Depleted for mine production to 30 June 2024. Non-recoverable Mineral Resources (sterile areas due to the proximity to stopes, unstable ground or where access to the vein is limited) defined as of 30 June 2024.

- Numbers may not compute exactly due to rounding.

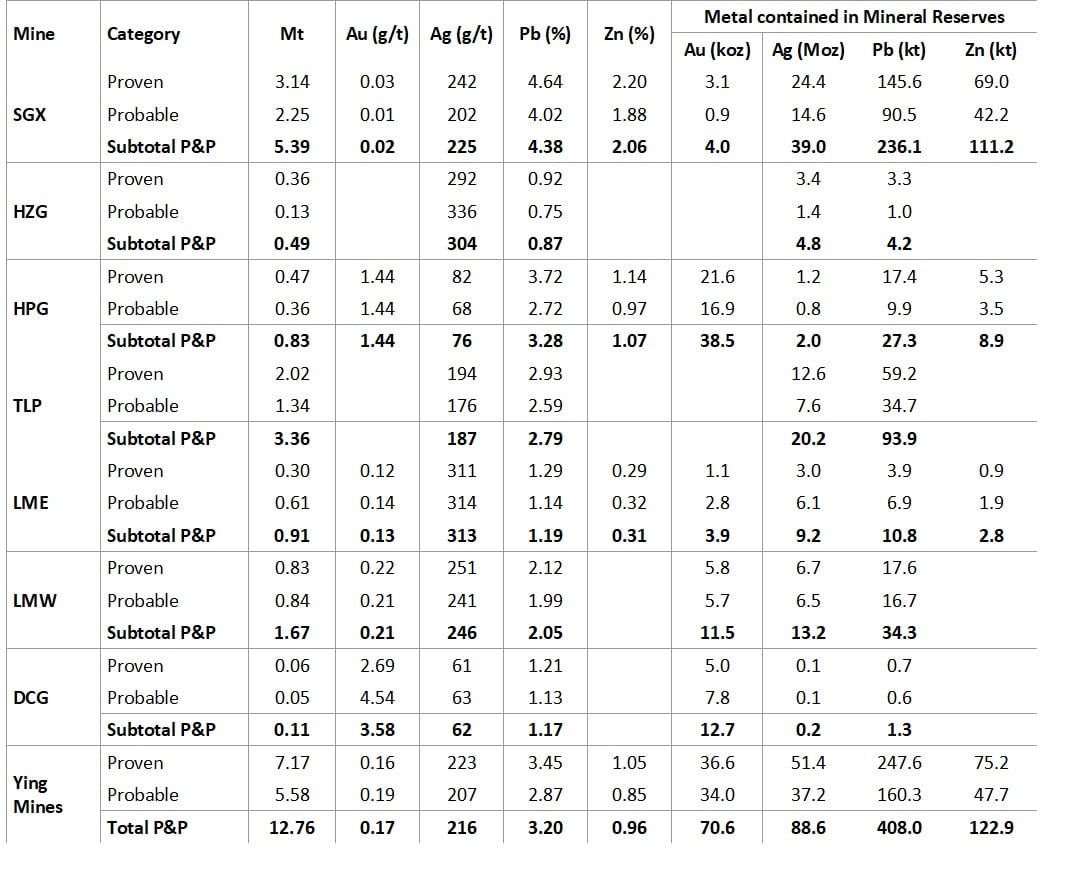

Notes:

- Cut‐off grades (AgEq g/t): SGX – 225 Resuing, 190 Shrinkage; HZG – 235 Resuing, 205 Shrinkage; HPG – 240 Resuing, 200 Shrinkage; TLP – 205 Resuing, 170 Shrinkage; LME – 235 Resuing, 210 Shrinkage, 205 Room & Pillar; LMW – 250 Resuing, 225 Shrinkage, 195 Longhole, 205 Room & Pillar; DCG – 275 Resuing, 235 Shrinkage.

- Stope Marginal cut‐off grades (AgEq g/t): SGX – 200 Resuing, 160 Shrinkage; HZG – 195 Resuing, 165 Shrinkage; HPG – 220 Resuing, 180 Shrinkage; TLP – 185 Resuing, 160 Shrinkage; LME – 205 Resuing, 185 Shrinkage, 150 Room & Pillar; LMW ‑ 195 Resuing, 165 Shrinkage, 140 Longhole, 150 Room & Pillar; DCG – 235 Resuing, 190 Shrinkage.

- Development Ore cut‐off grades (AgEq g/t): SGX – 125; HZG – 120; HPG – 145; TLP – 115; LME – 145; LMW – 125; DCG ‑ 150.

- Unplanned dilution (zero grade) assumed as 0.05 m on each wall of a resuing stope and 0.10 m on each wall of a shrinkage stope. 20% unplanned dilution assumed for LMW longhole. 17% average dilution for Room & Pillar at LME, 33% average dilution for Room & Pillar at LMW.

- Mining recovery factors assumed as 95% for resuing and 92% for shrinkage; for LMW longhole, 80% is assumed; for R&P at LME and LMW, 92% is assumed.

- Metal prices: gold US$1,800/troy oz, silver US$21.00/troy oz, lead US$1.00/lb, zinc US$1.10/lb.

- Processing recovery factors: SGX – 66.6% Au, 96.4% Ag, 97.6% Pb, 60.5% Zn; HZG – 96.4% Ag, 93.6% Pb; HPG ‑ 92.0% Au, 89.9% Ag, 91.4% Pb, 67.8% Zn; TLP – 94.0% Ag, 90.3% Pb; LME – 66.9% Au, 95.6% Ag, 90.4% Pb, 31.3% Zn; LMW – 88.3% Au, 96.8% Ag, 95.7% Pb; DCG – 85.7% Au, 80.9% Ag, 77.6% Pb.

- Payables: Au – 85%; Ag – 92.5%; Pb – 98.0%; Zn – 73.7%.

- Exclusive of mine production to 30 June 2024.

- Exchange rate assumed is RMB 7.00 : US$1.00.

- Numbers may not compute exactly due to rounding.