VANCOUVER, British Columbia – February 2, 2021 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX/NYSE American: SVM) announces its subsidiary, New Infini Silver Inc. (“New Infini”), has acquired a 100% interest in the La Yesca Silver Project (“La Yesca” or the “Project”), a silver-polymetallic, epithermal-type project located in Nayarit State, Mexico, approximately 100 kilometres (“km”) (185 km by road) northwest from Guadalajara, the second-largest city in Mexico.

La Yesca Silver Project

The Project covers an area of approximately 47.7 square km. Previous exploration activities between 2014 and 2018 included geological mapping, stream sediment and soil geochemical surveys, and widely-spaced drilling. A silver-lead-zinc soil geochemical anomaly of more than 500 metres (“m”) wide by 7.5 km long has been defined.

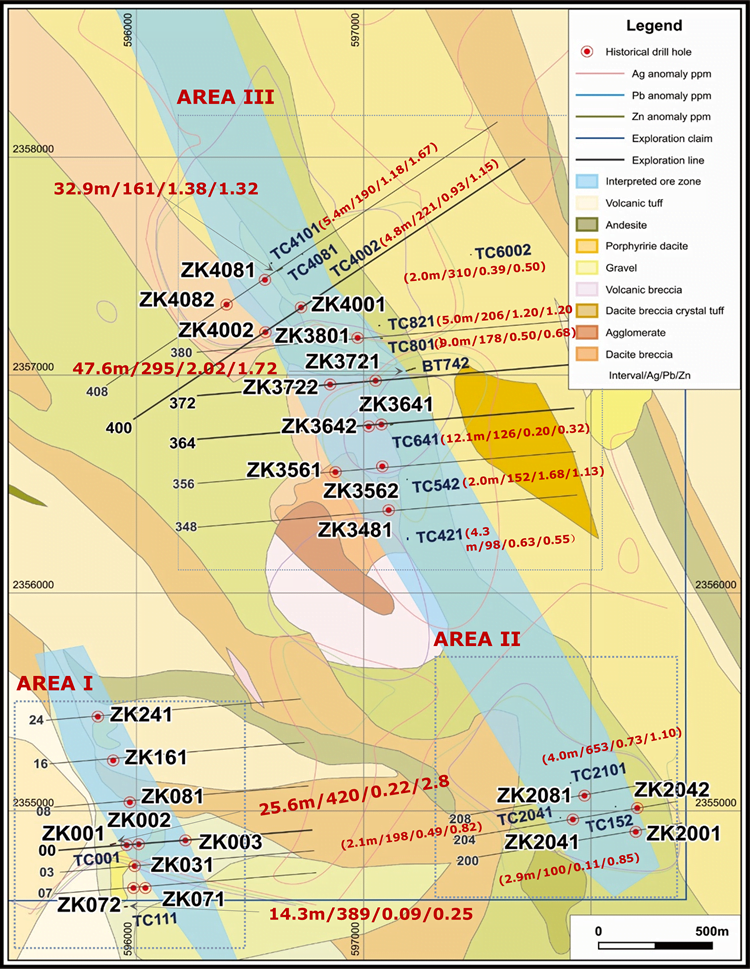

A total of 4,878 m3 in 106 trenches and surface strips and 7,649 m of diamond drilling in 25 widely-spaced drill holes has been completed to test the southern half of the 7.5 km long geochemical anomaly in Areas I, II, and III (see Figure 1). Fifty-six surface trenches and all of the 25 near vertically-drilled holes intersected mineralization, with 22 of the drill holes intersecting multiple mineralized intervals that have defined a northwest-trending 1,100 m long and 200 m wide mineralized zone in Area I, and a 3,500 m long and 400m wide zone in Areas II and III (see Figure 1).

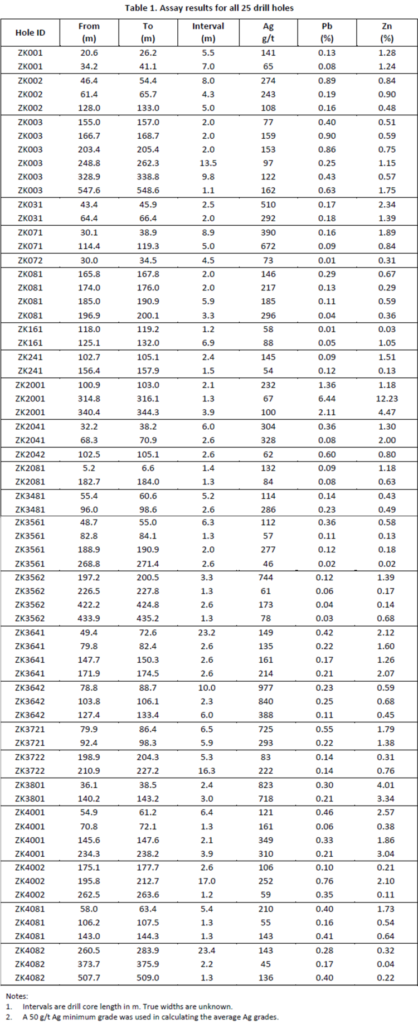

Highlights of selected drill hole intercepts (see Table 1 for details):

- Hole ZK3562 intercepted a 3.3 m interval from 197.2 m, grading 744 grams per tonne (“g/t”) silver (“Ag”), 0.12% lead (“Pb”) and 1.39% zinc (“Zn”);

- Hole ZK3642 intercepted a 10.0 m interval from 78.8 m, grading 977 g/t Ag, 0.23% Pb and 0.59% Zn, and a 2.3 m interval from 103.8 m, grading 840 g/t Ag, 0.25% Pb and 0.68 % Zn, and a 6.0 m interval from 127.4 m, grading 388 g/t Ag, 0.11% Pb and 0.45% Zn;

- Hole ZK3721 intercepted a 6.5 m interval from 79.9 m, grading 725 g/t Ag, 0.55% Pb and 1.79% Zn, and a 5.9 m interval from 92.4 m, grading 293 g/t Ag, 0.22% Pb and 1.38% Zn;

- Hole ZK3801 intercepted a 2.4 m interval from 36.1 m, grading 823 g/t Ag, 0.30% Pb and 4.01% Zn, and a 3.0 m interval from 140.2 m, grading 718 g/t Ag, 0.21% Pb and 3.34% Zn; and

- Hole ZK4002 intercepted a 17.0 m interval from 195.8 m, grading 252 g/t Ag, 0.76% Pb and 2.10% Zn.

Highlights of selected surface trench samples (see Figure 1):

- TC001 from Area I graded 420 g/t Ag, 0.22% Pb, and 2.80% Zn across 25.6 m;

- TC111 from Area I graded 389 g/t Ag, 0.09% Pb, and 0.25% Zn across 14.3 m;

- BT742 from Area III graded 295 g/t Ag, 2.02% Pb, and 1.72% Zn across 47.6m; and

- TC4081 from Area III graded 161 g/t Ag, 1.38% Pb and 1.32% Zn across 32.9 m.

Figure 1. Project focus area map

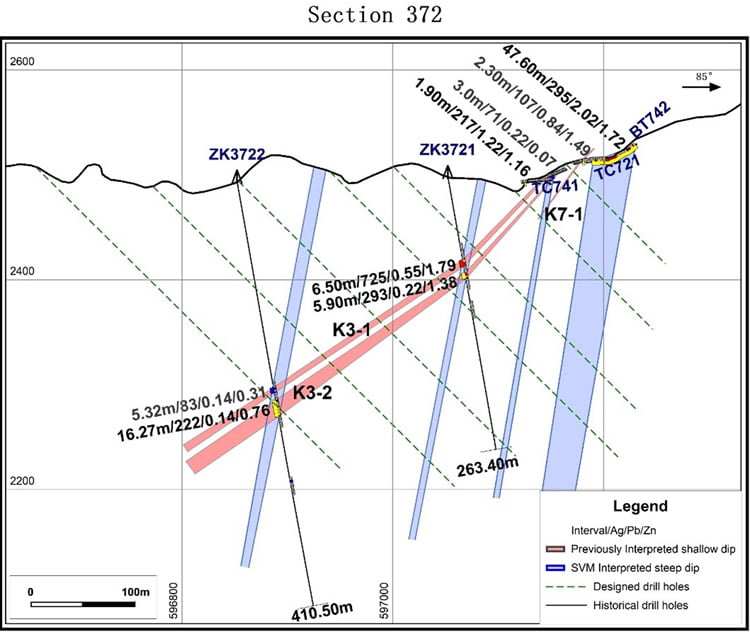

As the 25 drill holes were widely spaced, near vertically-drilled and all intercepted mineralization, the previous owner interpreted the silver mineralization as sub-horizontal or low angle dipping zones (30-40 degrees) (See Section 372 in Figure 2). During on-site due diligence trips, Silvercorp geologists observed abundant evidence of steeply-dipping (70-85 degrees) and northwest (325 degree) extending structures/mineralization in trenches and outcrops, and observed almost all mineralization fractures in drill cores as near parallel to the cores, yielding further evidence that mineralization may have occurred as sub-vertical (See Section 372 in Figure 2).

This may imply that the mineralized intervals intercepted by these 25 widely-spaced drill holes are from multiple, different zones. A hole drilled 100 m away to test trench mineralization may have intercepted new zones rather than the mineralized zone revealed by the trenches. The future drill program will drill holes at a 45 degree angle to either validate this new model or as in-fill drilling for the low-angle interpretation. For example, trench BT742, with a 47.6 m interval grading 295 g/t Ag, 2.02% Pb, and 1.72% Zn, can be easily tested by a 45 degree drill hole, whether it is a low-angle or sub-vertical zone.

Figure 2. Section 372 cross section

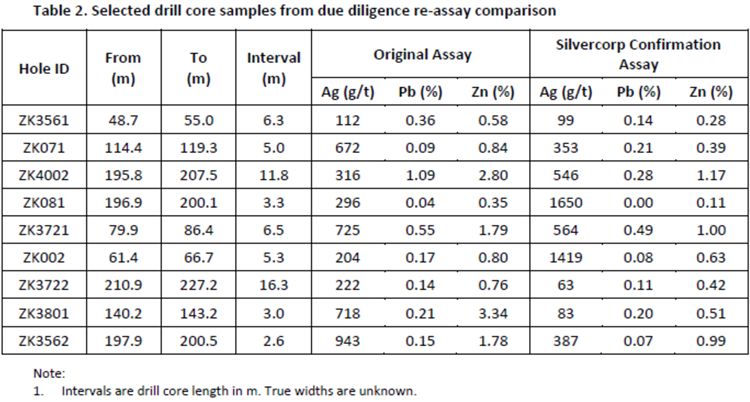

Silvercorp’s independent geological consultant also took core samples for re-assaying. The results shown in Table 2 have large variation, but all have significant, high silver grades.

Silvercorp Development Strategy

With successfully incubating New Pacific Metals Corp. and Whitehorse Gold Corp., Silvercorp intends to follow the same strategy and list New Infini as an independent public company, with a controlling interest, in the near future. This approach allows each company to operate independently on projects in different jurisdictions to reduce management risk and enables each company to pursue independent growth and capital allocation strategies while still maintaining Silvercorp’s interest, leadership, and core values. The success of this strategy is attributed to a disciplined and methodical approach in structuring and financing each new opportunity, and selecting and incentivizing dedicated and experienced executives and directors with a strong commitment to sustainable development and shared value creation.

Agreement Details and Share Structure

- In December 2020, Silvercorp’s 100%-owned subsidiary, New Infini, acquired a 100% interest in Infini Resources, S.A. de C.V. (“Infini SA”), a Mexican corporation which holds a 100% interest in the La Yesca project, in return for a US$9.25 million cash payment and a 45% interest in New Infini shares to the arm’s length vendors (the “Vendors”), pursuant to the terms and conditions of a framework agreement (the “Agreement”).

- The cash payment of US$9.25 million was provided by Silvercorp (US$7.57 million) and a group of Silvercorp’s directors, officers, employees, and consultants (US$1.68 million) in return for their interests of 45% and 10%, respectively, in New Infini.

- Through New Infini, Silvercorp assumed management and control of Infini SA and became the operator of the Project.

- A “discovery payment” of up to $30 million calculated on the basis of US$0.20 per ounce of silver resources as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), is payable by New Infini to the Vendors subject to certain permitting considerations.

- A subsequent private placement financing for New Infini in January 2021 raised US$4.0 million by issuing 8 million shares of New Infini at US$0.50 per share to Silvercorp, the Vendors and the management team. The funds will be sufficient to finance an initial drilling campaign of 10,000 m prior to listing New Infini as an independent public company.

- The current New Infini share structure after the January 2021 financing has Silvercorp at 21 million shares (43.75%), the Vendors at 18.6 million shares (38.75%), and management team at 8.4 million shares (17.50%) of the total 48 million shares outstanding.

Future Exploration Plans

New Infini has assembled a team in Mexico to apply for drilling permits and to initiate a Phase I 10,000 m drilling program, which is expected to start in Q2 2021, once permits are received.

The technical information contained in this news release has been reviewed and approved by Ruijin Jiang, P. Geo., who is a Qualified Person for the purposes of NI 43-101.

About Silvercorp

Silvercorp is a profitable Canadian mining company producing silver, lead and zinc metals in concentrates from mines in China. The Company’s goal is to continuously create healthy returns to shareholders through efficient management, organic growth and the acquisition of profitable projects. Silvercorp balances profitability, social and environmental relationships, employees’ wellbeing, and sustainable development. For more information, please visit our website at www.silvercorp.ca.

For further information

Lon Shaver

Vice President

Silvercorp Metals Inc.

Phone: (604) 669-9397

Toll Free: 1 (888) 224-1881

Email: [email protected]

Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER – FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws (collectively, “forward-looking statements”). Any forward-looking statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements relate to, among other things: future profitability, growth, acquisitions and shareholder returns, and potential future offerings of Securities.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, social and economic impacts of COVID-19; risks relating to: fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licenses; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China, Canada and Mexico; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; and bringing actions and enforcing judgments under U.S. securities laws, as well as those risks and uncertainties discussed in the Company’s corresponding MD&A and other public filings of the Company. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements.

Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those expressed or implied in the forward-looking statements.

The Company’s forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that while considered reasonable by management of the Company, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and opinions include, but are not limited to, those related to the Company’s ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry. Other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

CAUTIONARY NOTE TO US INVESTORS

This news release has been prepared in accordance with the requirements of NI 43‐101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. Securities laws. NI 43‐101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.