MAY 5, 2008

VANCOUVER, British Columbia – May 5, 2008 – Silvercorp Metals Inc. (the “Company”) is pleased to announce select unaudited financial and operational results for the 4th quarter and year ended March 31, 2008. The financial results are expressed in US dollars (US$), other than share and mining data, and are based on Canadian GAAP.

For the year ended March 31, 2008, sales increased by $68.6 million (CAD$66.6 million), or 172% to $108.4 million (CAD$111.9 million) compared to $39.8 million (CAD$45.3 million) for the same period last year.

FOURTH QUARTER FINANCIAL HIGHLIGHTS (3 Months – Unaudited)

During the 4th quarter ended March 31, 2008, total sales amounted to $26.8 million (CAD$27.0 million) a 101% increase over the prior year’s sales of $13.4 million (CAD$15.5 million).

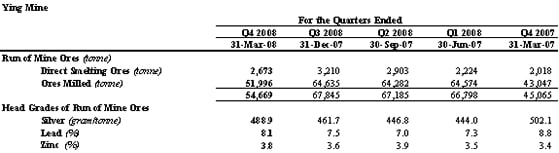

For this quarter, a total of 72,488 (2007 – 45,065) tonnes of ores were mined, from which 3,169 (2007 – 2,018) tonnes of direct smelting ores were hand sorted for direct shipment to smelters, and 69,319 (2007 – 43,047) tonnes of ores were shipped to mills for treatment to recover silver-lead and zinc concentrates. The average mining cost is $50.31 (2007 – $63.18) per tonne of ore and average milling cost is $12.10 (2007 – $18.00) per tonne of ore.

FOURTH QUARTER OPERATIONAL HIGHLIGHTS (3 Months – Unaudited)

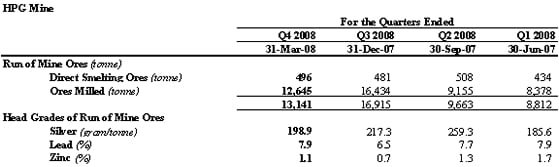

During the 4th quarter of 2008, the Company milled 23,590 tonnes (Q3 2008 – 3,959 tonnes) of purchased ore with head grades of 276.1 gram/tonne (g/t) (Q3 2008 – 211.7 g/t) for silver and 2.1% for lead (Q3 2008 – 1.2% for lead).

Total sales and realized prices net of value added tax and smelter charges for the 4th quarter ended March 31, 2008, are comprised of the following:

> 1,000,534 ounces of silver sold for $12,897,563 at an average selling price of $12.89 per ounce;

> 461 ounces of gold sold for $226,746 at an average selling price of $491.86 per ounce;

> 11,697,714 pounds of lead sold for $12,405,860 at an average selling price of $1.06 per pound; and,

> 2,393,274 pounds of zinc sold for $1,314,410 at an average selling price of $0.55 per pound.

The 4th quarter is traditionally a slower quarter for the Company as the traditional Chinese Spring Festival normally occurs in January or February, therefore, the Company’s mining operations were shut down for two and one-half weeks. In addition, the Company’s production in this quarter was affected by the severe weather for about 15 days.

The Company’s subsidiary, Henan Found Mining Company Ltd. (“Henan Found”), is now subject to 15% income tax rate until December 31, 2010. Based on this income tax rate and Chinese GAAP, Henan Found has paid $1.3 million in tax in the 4th quarter ended March 31, 2008.

2008 FINANCIAL HIGHLIGHTS (12 Months- Unaudited)

For the year ended March 31, 2008, a total of 306,143 (2007- 169,830) tonnes of ores were mined, from which 12,929 (2007 – 6,843) tonnes of direct smelting ores were hand sorted for direct shipment to smelters, and 293,214 (2007 – 162,987) tonnes of ores were shipped to mills for treatment to recover silver-lead and zinc concentrates. The average mining cost is $50.44 (2007 – $40.74) per tonne of ore and average milling cost is $11.69 (2007 – $17.68) per tonne of ore.

2008 OPERATIONAL HIGHLIGHTS (12 Months – Unaudited)

The head grades of run of mine ores of 253,839 tonnes from the Ying Mine for the year ended March 31, 2008, are:

> 464.2 g/t for silver;

> 7.4% for lead; and,

> 3.1% for zinc, respectively.

The head grades of run of mine ores of 52,304 tonnes from the HPG Mine for the year ended March 31, 2008, are:

> 207.4 g/t for silver;

> 7.4% for lead; and,

> 1.1% for zinc, respectively.

Total sales and realized prices net of value added tax and smelter charges for the year ended March 31, 2008, are comprised of the following:

> 3,960,189 ounces of silver sold for $44,677,949 at an average selling price of $11.28 per ounce;

> 2,152 ounces of gold sold for $1,189,764, at an average selling price of $552.86 per ounce;

> 49,623,448 pounds of lead sold for $48,433,127 at an average selling price of $0.98 per pound; and,

> 15,911,881 pounds of zinc sold for $14,061,922 at an average selling price of $0.88 per pound.

CHANGE IN REPORTING CURRENCY

Effective April 1, 2007, the Company changed its reporting currency to the US dollar. The change in reporting currency is to better reflect the Company’s business activities and to improve investors’ ability to compare the Company’s financial results with other publicly traded businesses in the mining industry. Prior to April 1, 2007, the Company reported its annual and quarterly consolidated balance sheets and the related consolidated statements of operations and cash flows in the Canadian dollar (CAD). In making this change in reporting currency, the Company followed the recommendations of the Emerging Issues Committee (EIC) of the Canadian Institute of Chartered Accountants (CICA), set out in EIC-130, “Translation Method when the Reporting Currency Differs from the Measurement Currency or there is a Change in the Reporting Currency”. In accordance with EIC-130, the financial statements for all years and periods presented have been translated into the new reporting currency using the current rate method. Under this method, the statements of operations and cash flows statements items for each year and period have been translated into the reporting currency using the average exchange rates prevailing during each reporting period. All assets and liabilities have been translated using the exchange rate prevailing at the consolidated balance sheets dates. Shareholders’ equity transactions since April 1, 2005 have been translated using the rates of exchange in effect as of the dates of the various capital transactions, while shareholders’ equity balances on April 1, 2005 have been translated at the exchange rate on that date. All resulting exchange differences arising from the translation are included as a separate component of other comprehensive income. All comparative financial information has been restated to reflect the Company’s results as if they had been historically reported in US dollars.

OUTLOOK

The Company is well positioned to grow through consolidating the fragmented primary silver sector in China, starting from its foot-hold in Henan Province. With the encouragement of local county government, the Company, through its acquisition of the LM and TLP Silver-Lead Mines, is consolidating the silver, lead, and zinc mines and exploration properties in the Ying/HPG Silver Mining camp, providing a solid base from which to significantly expand resources and growth potential.

Through consolidation of the Ying Mining Camp over the last six months, the Company is now operating four mines at the Ying Camp and is increasing its mill throughput to 3,000 tonnes per day from its current throughput of 1,300 tonnes per day. With the recently announced purchase (to close before June 8, 2008), of the Gaocheng (“GC”) and Shimentou (“SMT”) Properties in Guangdong Province., Silvercorp expects to realize the benefits of growth in resources and near term production from a new mining camp in a different province. It also establishes a new base for further consolidation of the prolific GC silver, lead, zinc mining district.

The Company’s historical unaudited Interim Consolidated Financial Statements and Management’s Discussion and Analysis are available for review on our website at www.silvercorp.ca and through SEDAR at www.sedar.com.

About Silvercorp Metals Inc.

Silvercorp Metals Inc. is engaged in the acquisition, exploration, and development of silver related mineral properties focusing in the People’s Republic of China (“China”). Currently, the Company is operating and developing four Silver-Lead-Zinc mines at the Ying Mining Camp, Henan Province, owned through its 77.5% and 70% Chinese subsidiaries, respectively and is also exploring the Na-Bao Polymetalic Project in Qinghai Province, China owned through its 82% Chinese subsidiary.

The Company’s common shares are included as a component of the S&P/TSX Composite, the S&P/TSX Global Gold, and the S&P/TSX Global Mining Indexes.

For further information: SILVERCORP METALS INC., Rui Feng, Chairman & CEO, & Lorne Waldman, Corporate Secretary.

Phone: (604) 669-9397, Fax: (604) 669-9387, Email: [email protected], Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER — FORWARD LOOKING STATEMENTS

Statements in this press release other than purely historical factual information, including statements relating to mineral resources and reserves, or the Company’s future plans and objectives or expected results, constitute forward-looking statements. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company’s business, including risks inherent in mineral exploration, development, and mining. Production and revenue projections are based not on mineral reserves but on mineral resources which do not have demonstrated economic viability. As a result, actual results may vary materially from those described in the forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on such statements. The Company does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws. The Company expressly disclaims any obligation to update any forward-looking statements. We seek safe harbour.