AUGUST 13, 2008

VANCOUVER, British Columbia – August 13, 2008 – Silvercorp Metals Inc. (the “Silvercorp” of “Company”) is pleased to announced the unaudited financial and operating results for the first quarter ended June 30, 2008. The financial results in the following text are expressed in US dollars (US$) unless stated otherwise.

FIRST QUARTER HIGHLIGHTS

> Record sales revenue of US$30.9 million, an increase of 39% from the prior year period

> Record cash flow from operation of US$25.1 million, an increase of 33% from the prior year period

> Record silver production of 1.1 million ounces, an increase of 27% from the prior year period

> Industry leading low total production costs per ounce of silver are continuing to be achieved with a cash cost for silver production at negative $6.79 per ounce after adjustment for by-product credits

> Achieved limited production and profit at the TLP and LM Mines within only three months after their acquisition

The Company has noted an improved outlook for its power supply problems outlined in the August 8, 2008 news release. There has been no power rationing for the last five days. The local County Utility Bureau has assured the Company minimum power rationing as power supply to the local county has also improved when a new hydro power generating project in the County was brought into operation last week. Management is working closely with the local Utility Bureau to minimize future power interruptions, including investing almost $1 million since last May to build a new power line to the Ying Mine. The new power line is expected to be complete by the end of this August. The Company is also expanding diesel power generating capacity at the Ying mine to cope with potential power rationing. Further guidance on the power situation will be provided as the situation evolves.

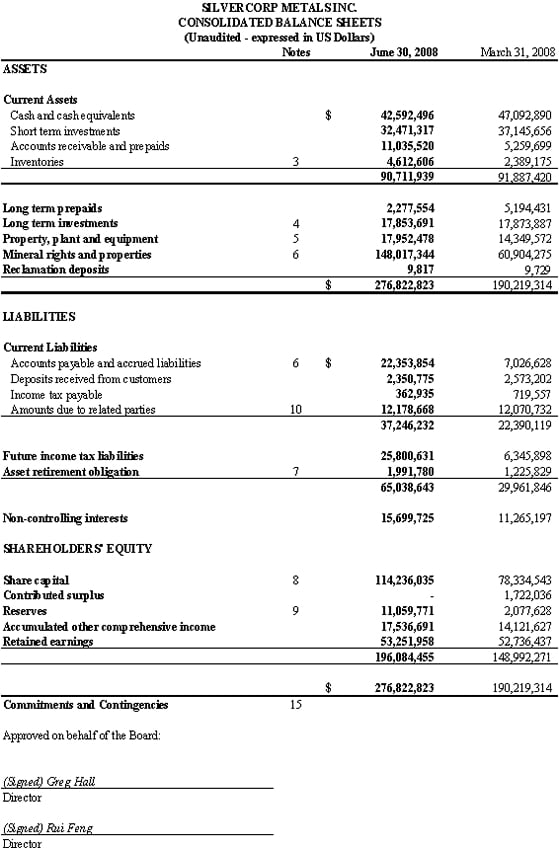

FINANCIAL HIGHLIGHTS

For the 1st quarter ended June 30, 2008, the Company achieved record sales of $30.9 million, compared to $22.3 million for the same period one year ago. This represents an increase of 39% in sales revenue. Gross profit from operations amounted to $21.4 million (2007 – $17.4 million), an increase of 23% and representing a gross margin of 69% (2007 – 78%). Earnings before other income and expenses increased 13% to $17.1 million (2007 – $15.1 million). The net income was $11.6 million (2007 – $14.5 million) with a net profit margin of 38% (2007 – 65%). Net earnings of $0.08 per basic share represent $0.02 less compared to $0.10 per basic share for the same period last year.

After adjusting the prior year’s net income for an income tax benefit of $1.5 million, and mineral property option income of $1.9 million, net income for the 1st quarter ended June 30, 2008 in fact increased by 4% to $11.6 million as compared to adjusted net income for the prior year’s quarter of $11.2 million. The basic earnings per share of $0.08 for the 1st quarter ended June 30, 2008 is comparable to the adjusted basic earnings per share of $0.08 for the same period one year ago.

Cash provided by operating activities rose 33% to a record of $25.1 million ($0.17 per share) for the 1st quarter ended June 30, 2008, a 33% increase compared to $18.9 million ($0.13 per share) over the same period one year ago.

Net profit and the net earnings per share for the quarter ended June 30, 2008 did not increase in line with increased sales compared to the same period one year ago mainly due to the following reasons: (i) the Company mined low grade areas at the Ying Mine as outlined in the 2007 Resources Upgrade report by Mr. C. Broili and Dr. M. Klohn contributing to the $3.7 million increase in cash cost of goods sold; (ii) $1.2 million increase in amortization, depreciation, and depletion cost; (iii) $0.2 million increase in general exploration expenses; (iv) $1.8 million increase in administrative and professional fees; and (v) income tax expense of $2.1 million as the Company started to pay income tax in China and a tax provision of $2.0 million was recorded.

Capital expenditures during the period amounted to $35.3 million (2007- $4.3 million) representing the purchase of mineral rights and properties of $31.5 million (2007 – $2.8 million) and the purchase of property, plant, and equipment of $3.8 million (2007 – $1.5 million). The Company ended the quarter with cash and cash equivalents and short term investments of $75.1 million (2007 – $72.6 million).

During the 1st quarter ended June 30, 2008, the Company, through the facilities of the TSX Exchange, acquired 764,300 shares under the Normal Course Issuer Bid at a total cost of $4.7 million of which 470,000 shares were cancelled. Subsequent to June 30, 2008, the Company acquired 325,400 common shares under the Normal Course Issuer Bid at a cost of $1.6 million and the remaining 619,700 common shares were cancelled.

OPERATIONAL HIGHLIGHTS

During the quarter, the Company reached limited test production at the LM Mine and TLP Mine. This has enabled the Company to achieve record silver production of 1,106,282 ounces during the quarter, representing an increase of 27% compared to the prior year.

Total sales and realized prices net of value added tax and smelter charges for the 1st quarter ended June 30, 2008 as compared to the same period of 2007, are comprised of the following:

> 1,106,282 (2007 – 870,608) ounces of silver sold for $15.4 million (2007 – $9.4 million) at an average selling price of $13.93 (2007 – $10.86) per ounce;

> 525 (2007 – 323 ) ounces of gold sold for $0.3 million (2007 – $0.1 million) at an average selling price of $661.24 (2007 – $452.05) per ounce;

> 14,427,862 (2007 – 11,269,546) pounds of lead sold for $12.8 million (2007 – $8.3 million) at an average selling price of $0.89 (2007 – $0.74) per pound; and,

> 4,165,194 (2007 – 3,849,273) pounds of zinc sold for $2.3 million (2007 – $4.3 million) at an average selling price of $0.55 (2007 – $1.13) per pound.

For the 1st quarter ended June 30, 2008, a total of 135,944 (2007- 70,816) tonnes of ores were mined, representing a 92% increase compared to the same period of 2007, from which 3,388 (2007 – 2,658) tonnes of direct smelting ores were hand sorted for direct shipment to smelters, and 132,556 (2007 – 68,158) tonnes of ores were shipped to mills for treatment to recover silver-lead and zinc concentrates.

The total mining cost per tonne of ore mined increased by 60% compared to the same period of 2007 to $73.45 per tonne ($/t) (2007 – $46.00/t), primarily caused by: an increase in amortization and depletion of $10.40/t; an increase in raw materials supply cost of $5.84/t; and, an increase in exploration cost of $10.73/t.

The total milling cost per tonne of ore milled has increased by 22% to $13.39 per tonne of ore ($/t) (2007 – $11.00), mainly due to: an increase in depreciation of $1.00/t (2007 – nil); an increase in administration and transportation costs of $1.84/t; salary increase of $0.33/t; resource tax increase of $0.88/t; and, offset by raw materials decrease of $0.99/t, and utility cost decrease of $0.50/t.

The Company continues to achieve industry leading low total production costs per ounce of silver. The total production cost increased by 41% to negative $5.37 per ounce of silver after adjusting for by-product credits for the 1st quarter ended June 30, 2008, compared to negative $9.12 per ounce in the same period a year ago. The cash production cost for silver adjusted for by-product credits increased by 31% to negative $6.79 (2007 – negative $9.79) per ounce.

Ying Mine

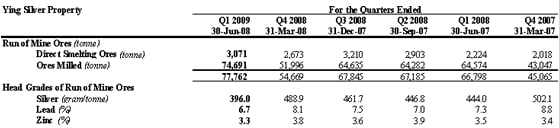

The head grades of run of mine ores of 77,762 and 66,798 tonnes from the Ying Mine for the 1st quarter ended June 30, 2008 and June 30, 2007 respectively, were:

> 396.0 and 444.0 g/t for silver, a decrease of 11%; > 6.7% and 7.3% for lead, a decrease of 8%; and, > 3.3% and 3.5% for zinc, a decrease of 7%.

The following table lists the grade changes over the last six quarters at the Ying Mine:

As the mining process at the Ying Mine is going through certain lower grade pockets of ore zones, it is expected that the head grades of run of mine ores from the Ying Mine will be the similar to this quarter for at least one quarter, until those higher grade pockets of ore zones are developed.

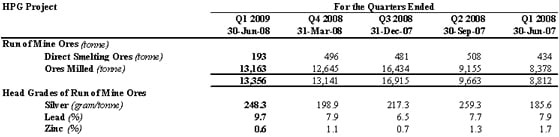

HPG Mine

The head grades of run of mine ores of 13,356 and 8,812 tonnes from the HPG Mine for the 1st quarter ended June 30, 2008 and June 30, 2007, were:

> 248.3 and 185.6 g/t for silver, an increase of 34%;

> 9.7% and 7.9% for lead, an increase of 23%; and,

> 0.6% and 1.7% for zinc, a decrease of 62%, respectively.

The following table lists the grade changes over the last five quarters at the HPG Mine:

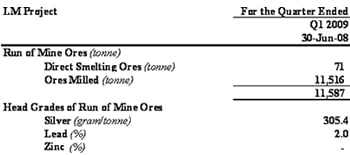

LM Mine

The LM Mine, in its first quarter of test production, achieved head grades of run of mine ores of 11,587 tonnes for the 1st quarter ended June 30, 2008 of:

> 305.4 g/t for silver; and,

> 2.0% for lead.

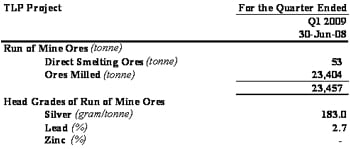

TLP Mine

The TLP Mine, in its first quarter of test production, achieved head grades of run of mine ores of 23,457 tonnes for the 1st quarter ended June 30, 2008 of:

> 183.0 g/t for silver; and,

> 2.7% for lead.

OUTLOOK

Currently, the Company is operating and developing four Silver-Lead-Zinc mines at the Ying Mining Camp, Henan Province, owned through its 77.5% and 70% Chinese subsidiary companies. For the Ying Mine, as the mining process is working through certain low grade areas at the Ying Mine as outlined in 2007 resources upgrade by Mr. C. Broili and Dr. M. Klohn, it is expected that the head grade of run of mine ores from the Ying Mine will be similar to this quarter for at least one quarter, until those higher grade pockets of ore zones are developed. This may result in the Company’s bottom line not increasing during this period, as the Ying Mine represented 80% of the Company’s total revenue for the last quarter.

For the TLP Mine, mining preparation and development are ramping up to reach capacity of 900 tonnes of ore per day (or 300,000 tonnes per year) in about two to three quarters. This may improve the Company’s sales and profit. The Company is still in the process of transferring the mining permits from the previous owner to the Company’s subsidiary Henan Found which remain subject to receipt of all necessary approvals from the Governmental departments of the Henan Province.

In Guangdong Province, the Company is applying for a mining permit for the newly acquired GC/SMT property, owned through a 95% Chinese subsidiary. Silvercorp is also exploring the Na-Bao Polymetallic Project in Qinghai Province, China owned through its 82% Chinese subsidiary.

The Company’s Audited Annual and Unaudited Interim Consolidated Financial Statements and Management’s Discussion and Analysis are available for review on our website at www.silvercorp.ca and through SEDAR at www.sedar.com.

Selected unaudited interim consolidated results for the three months ended June 30, 2008 (Canadian GAAP) are attached to this news release.

CONFERENCE CALL AND WEBCAST INFORMATION

A conference call and live audio webcast to discuss the results have been scheduled as follows:

Date: Thursday, August 14th, 2008

Time: 9:00 am PST (12:00 pm EST)

Dial-In Number: 1-651-291-5254

Live audio webcast: www.silvercorp.ca

Playback webcast can be accessed at: www.silvercorp.ca

About Silvercorp Metals Inc.

Silvercorp Metals Inc., China’s largest primary silver producer, is engaged in the acquisition, exploration, and development of silver related mineral properties focusing in the People’s Republic of China (“China”). Silvercorp Metals Inc. is operating and developing four highly profitable Silver-Lead-Zinc mines at the Ying Mining Camp, Henan Province, China. Silvercorp is also applying for a mining permit for the newly acquired 95% owned GC/SMT property to profitably mine and produce silver, lead and zinc metals in Guangdong Province, China. In addition, Silvercorp is also exploring the 82% owned Na-Bao Polymetallic Project in Qinghai Province, China.

The Company’s common shares are included as a component of the S&P/TSX Composite, the S&P/TSX Global Gold, and the S&P/TSX Global Mining Indexes.

For further information: SILVERCORP METALS INC., Rui Feng, Chairman & CEO, & Lorne Waldman, Corporate Secretary. Phone: (604) 669-9397, Toll Free Phone: 1-888-224-1881, Fax: (604) 669-9387, Email: info@silvercorp.ca, Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Statements in this press release other than purely historical factual information, including statements relating to mineral resources and reserves, or the Company’s future plans and objectives or expected results, constitute forward-looking statements. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in the Company’s business, including risks inherent in mineral exploration, development, and mining. Production and revenue projections are based not on mineral reserves but on mineral resources which do not have demonstrated economic viability. As a result, actual results may vary materially from those described in the forward-looking statements. There can be no assurance that such forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on such statements. The Company does not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws. The Company expressly disclaims any obligation to update any forward-looking statements. We seek safe harbour.