VANCOUVER, British Columbia – July 16, 2020 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX/NYSE American: SVM) reports production results for the first quarter of Fiscal 2021 ended June 30, 2020 (“Q1 Fiscal 2021”). The Company produced approximately 1.8 million ounces of silver, 20.1 million pounds of lead, and 7.5 million pounds of zinc. The Company is on track to produce between 6.2 – 6.5 million ounces of silver, 66.1 – 68.5 million pounds of lead, and 24.5 – 26.7 million pounds of zinc in Fiscal 2021, in accordance with the annual production guidance previously reported in the Company’s news release dated February 6, 2020. The Company will report its sales volumes along with its unaudited financial and operating results for Q1 Fiscal 2021, expected to be released on Thursday, August 6, 2020 after market close.

Q1 FISCAL 2021 CONSOLIDATED PRODUCTION HIGHLIGHTS

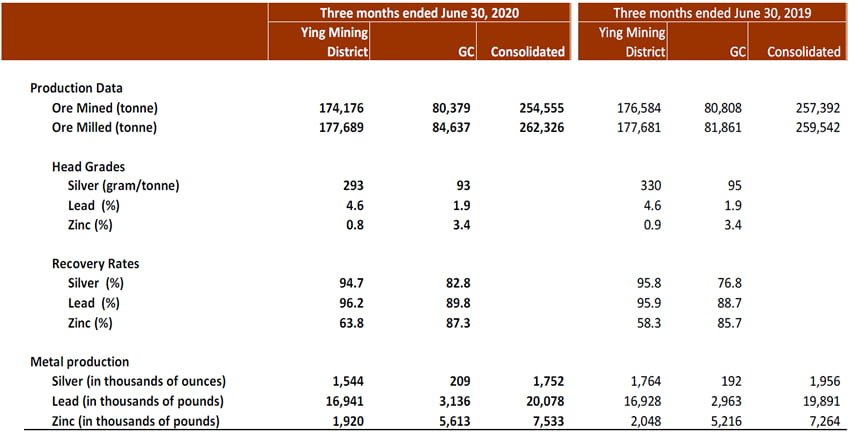

- Ore mined of 254,555 tonnes, a 1% decrease over Q1 Fiscal 2020

- Silver production of approximately 1.8 million ounces, a 10% decrease over Q1 Fiscal 2020;

- Lead production of approximately 20.1 million pounds, a 1% increase over Q1 Fiscal 2020; and

- Zinc production of approximately 7.5 million pounds, a 4% increase over Q1 Fiscal 2020.

Q1 FISCAL 2021 CONSOLIDATED OPERATIONAL RESULTS

Ying Mining District

In Q1 Fiscal 2021, metals production at the Ying Mining District was approximately 1.5 million ounces of silver, 16.9 million pounds of lead, and 1.9 million pounds of zinc. The Ying Mining District is on track to achieve its annual production guidance.

Ore mined at the Ying Mining District was 174,176 tonnes, a slight decrease compared to 176,584 tonnes in Q1 Fiscal 2020. Ore milled was 177,689 tonnes, with average head grades of 293 grams per tonne (“g/t”) for silver, 4.6% for lead, and 0.8% for zinc, compared to 177,681 tonnes ore milled with head grades of 330 g/t for silver, 4.6% for lead, and 0.9% for zinc. The variation in the Q1 Fiscal 2021 silver head grade is mainly related to the Company’s planned mining sequence and is in line with the guidance previously provided for Fiscal 2021.

GC Mine

In Q1 Fiscal 2021, metals production at the GC Mine was approximately 209,000 ounces of silver, 3.1 million pounds of lead, and 5.6 million pounds of zinc, an increase of 9%, 6%, and 8%, respectively, compared to Q1 Fiscal 2020.

Ore mined at the GC Mine was 80,379 tonnes, a slight decrease compared to 80,808 tonnes in Q1 Fiscal 2020. Ore milled was 84,637 tonnes with head grades of 93 g/t for silver, 1.9% for lead, and 3.4% for zinc, compared to 81,861 tonnes with head grades of 95 g/t for silver, 1.9% for lead, and 3.4% for zinc in Q1 Fiscal 2020. Metallurgical recovery rates also improved to 82.8% for silver, 89.8% for lead, and 87.3% for zinc, compared to 76.8% for silver, 88.7% for lead, and 85.7% for zinc in Q1 Fiscal 2020.

About Silvercorp

Silvercorp is a profitable Canadian mining company producing silver, lead and zinc metals in concentrates from mines in China. The Company’s goal is to continuously create healthy returns to shareholders through efficient management, organic growth and the acquisition of profitable projects. Silvercorp balances profitability, social and environmental relationships, employees’ wellbeing, and sustainable development. For more information, please visit our website at www.silvercorp.ca.

For further information

Silvercorp Metals Inc.

Lon Shaver

Vice President

Phone: (604) 669-9397

Toll Free: 1(888) 224-1881

Email: [email protected]

Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER – FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws (collectively, “forward-looking statements”). Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties; the sufficiency of the Company’s capital to finance the Company’s operations; estimates of the Company’s revenues and capital expenditures; estimated production from the Company’s mines in the Ying Mining District and the GC Mine; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the Company’s operations; and access to and availability of funding for future construction, use of proceeds from any financing and development of the Company’s properties.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks relating to: social and economic impacts of COVID-19; fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licences; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China and Canada; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting; and bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.