VANCOUVER, British Columbia – May 8, 2019 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX / NYSE American: SVM) is pleased to report an updated National Instrument 43-101 Technical Report has been completed by RPMGlobal Asia Limited (“RPM”) on the Baiyunpu (“BYP”) gold-lead-zinc property in Hunan Province, People’s Republic of China (the “BYP NI 43-101 Technical Report”). The BYP NI 43-101 Technical Report, with an effective date of April 30, 2019, will be filed under the Company’s SEDAR profile at www.sedar.com within 45 days of this news release and on the Company’s website at www.silvercorp.ca.

The 2012 NI 43-101 report on the BYP property was based on data effective 2011. The current report is based on an additional 22 diamond drill holes and 1,099 metres of channel samples from tunnels.

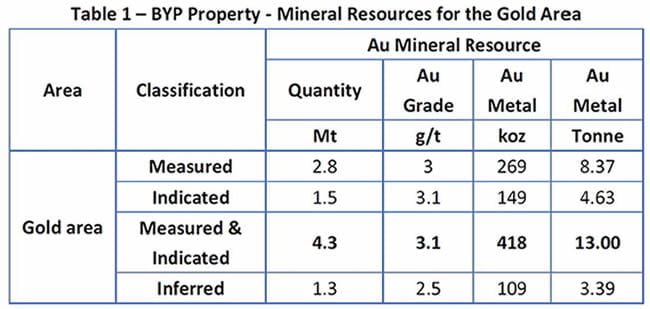

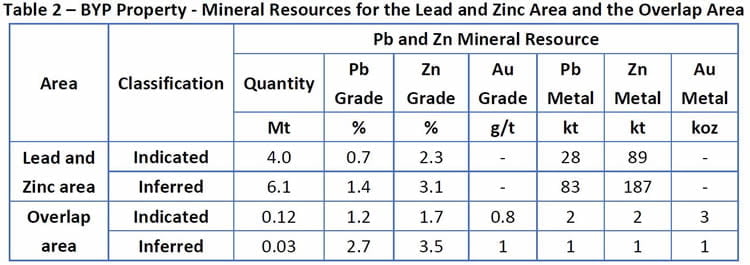

The results of the mineral resource estimates for the three physically distinct areas (gold, lead & zinc, and overlap) of the BYP project, as extracted from the BYP NI 43-101 Technical Report prepared by RPM, are presented in Tables 1 and 2. A 1.6 g/t Au cut-off grade was used for the gold area in the report based on the following parameters for the project: the previous underground mining operations, its processing cost, and 120% of the Consensus Price forecasts for the product element as at January 2019.

Notes:

- CIM Definition standards (2014) were used for reporting the Mineral Resources.

- All data current to November 30, 2018.

- Silvercorp owns 70% equity interest of BYP Au-Pb-Zn Project.

- Pb Equivalent (PbEq) formulas used for equivalent grade is: PbEq= Pb + Zn*1.3069 + Au*2.1386.

- Mineral Resources are reported on a dry, in-situ basis.

- The overlapped areas were reported inside lead and zinc resource table based on PbEq cut-off.

- Mineral Resources are reported at a 1.6 g/t Au cut-off and 3% Pb equivalent cut-off. Cut-off parameters were selected based on an RPM internal cut-off calculator in which the gold price of USD$1,490 per ounce, Lead price of USD$2,280/t and Zinc price of USD$2,760/t, increased to 120% of prices from “Energy & Metals Consensus Forecasts”, to reflect long term price movements were applied, and the mining cost of USD$35 per ton, processing cost of USD$13.3 per ton milled and processing recovery of 87.41% Au, 85.87% Pb and 92.71% Zn based on 2018 BYP development and utilization plan report were applied.

- No mining license depth limit was applied for the Mineral Resource reporting. No mining license depth limit was applied for the Mineral Resource reporting as the mining license update is still in progress.

- The Mineral Resources referred to above have not been subject to detailed economic analysis and therefore have not been demonstrated to have actual economic viability.

- It should be noted that for any SEC filings that the SEC does not recognize resources, only reserves and the resources stated above are classified as mineralized material with no value.

Mineral Resources estimated for the gold area include a total of 4.3 million tonnes grading 3.1 g/t Au in the Measured and Indicated categories, containing approximately 418,000 ounces of gold. The previous mining operation between 2011 and 2014 produced 221,000 tonnes of gold mineralized material at an average recovered grade of 3.56 g/t Au for approximately 25,335 ounces of recovered gold. Mineralization is open along strike and down dip for both the gold and lead-zinc areas.

Qualified Persons

Mr. Guoliang Ma, P.Geo., Manager of Exploration and Resource of the Company, is the Qualified Person for Silvercorp as defined by NI 43-101 and has reviewed and given consent to the technical information contained in this news release. Mr. Bob Dennis, Geologist of RPM, Mr. Tony Cameron, Principal Mining Engineer of RPM, and Mr. Huang Song, consultant for RPM, are Qualified Persons for the purposes of NI 43-101 and have reviewed and consented to this news release and believe it fairly and accurately represents the information in the BYP NI 43-101 Technical Report that supports the disclosure. The reader is directed to the BYP NI 43-101 Technical Report on SEDAR or the Company’s website for details of the estimate.

About Silvercorp

Silvercorp is a low-cost silver-producing Canadian mining company with multiple mines in China. The Company’s vision is to deliver shareholder value by focusing on the acquisition of under developed projects with resource potential and the ability to grow organically. For more information, please visit our website at www.silvercorp.ca.

For further information

Lon Shaver

Vice President

Silvercorp Metals Inc.

Phone: (604) 669-9397

Toll Free: 1(888) 224-1881

Email: [email protected]

Website: www.silvercorp.ca

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain of the statements and information in this press release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s Gaocheng property; the sufficiency of the Company’s capital to finance the Company’s operations; estimates of the Company’s revenues and capital expenditures; estimated production from the Company’s Gaocheng mine; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the Company’s operations; and access to and availability of funding for future construction, use of proceeds from any financing and development of the Company’s properties.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licenses; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China and Canada; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; and bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended March 31, 2018 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.