VANCOUVER, British Columbia – December 7, 2015 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX:SVM) is pleased to report the exploration results from the first three quarters of 2015 at the HPG mine, Ying Mining District, Henan Province, China.

The 2015 exploration program at the HPG mine was designed to upgrade the drill-defined mineral resources with exploration tunneling and to explore for new mineralization at the unexplored downdip and strike extensions of major production veins H17, H15 and H5W using underground diamond drilling. Drill targets on the strike extensions of H17 and H15 are distributed approximately from 50m to 300m northeastwards from the previously known mineralization within these vein structures. Results of the on-going exploration drilling program thus far demonstrate that mineralization of the major production veins H17, H15 and H15W have been extended for about 300m along the northeast strike direction between the 450m and the 100m elevations. The extended mineralization is well defined by mineralized intersections from seven diamond holes ZK3410, ZK3604, ZK3606, ZK3607, ZK3608, ZK3802 and ZK4201 between exploration lines 34 and 42. Exploration tunneling for resource upgrade has continuously exposed high-grade mineralization within production veins between levels 680m and 251m.

Highlights of selected high-grade mineralized zones exposed in drift tunnels include:

- Drift Tunnel PD3-H17-420NYM exposed mineralization of 162 meters (“m”) in length and 1.45m in true width grading 2.52 grams per tonne (“g/t”) gold (“Au”), 50 g/t silver (“Ag”), 2.50% lead (“Pb”) and 1.53% zinc (“Zn”) within vein structure H17 on the 420m level;

- Drift Tunnel PD3-H17-251-SYM exposed mineralization of 155m in length and 1.30m in true width grading 0.89g/t Au, 92g/t Ag, 3.61% Pb and 0.51% Zn within vein structure H17 on the 251m level; and

- Drift Tunnel PD88-H16-680-NYM1 exposed mineralization of 45m in length and 1.09m in true width grading 3.94g/t Au, 82g/t Ag, 1.21% Pb and 0.45% Zn within vein structure H16 on the 680m level.

A total of 6,206m of diamond drilling in 29 holes was completed using 2 underground rigs in the first three quarters of 2015. Diamond holes were drilled from drill stations located in underground workings on the 460m and the 300m levels to test multiple vein structures between the 450m and 100m elevations. A total of 316 core samples were collected from intersections of altered and mineralized vein structures. As of September 30, the Company received assay results for 24 holes, and 12 of the 24 holes intersected one or multiple mineralized zones and other holes intersected target vein structures. Assay for five holes are pending.

Exploration tunneling was conducted between the 680m and the 251m levels via access adits PD2, PD3, PD5, PD6, PD88, PD640 and PD630. A total of 3,974m of exploration tunneling, including 2,519m drift tunneling and 886m crosscut tunneling, was driven along and across production vein structures H17, H16, H15, H14, H13 and H12-1, and 1,252 channel samples were collected. As of September 30, 2015, the on-going exploration tunneling program exposed a total of 846m mineralization, 1.13m in average width, grading 1.59g/t Au, 70g/t Ag, 2.93% Pb and 1.07% Zn. The exposed mineralization constitutes 33% of the completed drift tunneling.

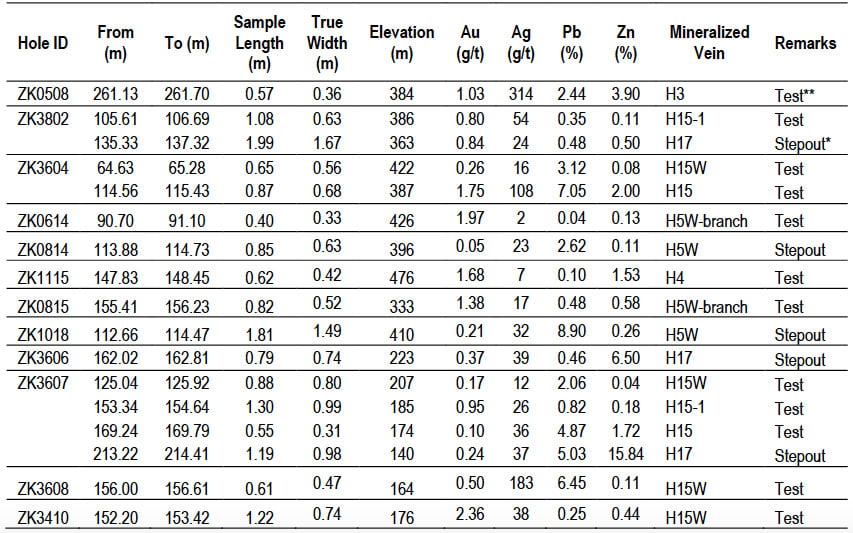

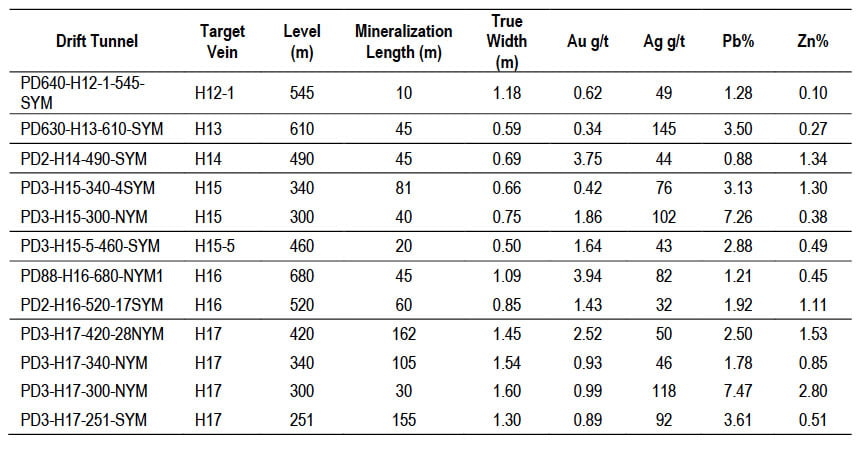

Tables 1 and 2 below list the assay results of some selected mineralized intersections in drill holes and mineralized zones exposed in drift tunnels.

Table 1: Selected drilling results from the HPG Mine in the first three quarters of 2015

*Stepout: intersections adjacent to existing resource blocks for resource expansion;

**Test: intersections in open areas without known mineralized intersections nearby.

Table 2: Selected mineralized zones exposed by exploration tunneling at the HPG Mine in the first three quarters of 2015

Quality Control

Drill cores are NQ size. Drill core samples, limited by apparent mineralization contact or shear/alteration contact, were split into halves by saw cutting. The half cores are stored in the Company’s core shacks for future reference and checking, and the other half core samples are shipped in security sealed bags to the Chengde Huakan 514 Geology and Minerals Testing and Research Institute in Chengde, Hebei Province, China, 226 km northeast of Beijing, and the Zhenzhou Nonferrous Exploration Institute Lab in Zhengzhou, Henan Province, China, and both labs are ISO9000 certified analytical lab. For analysis thesample is dried and crushed to minus 1mm and then split to a 200-300g subsample which is further pulverized to minus 200 mesh. Two subsamples are prepared from the pulverized sample. One is digested with aqua regia for gold analysis with AAS, and the other is digested with two-acids for analysis of silver, lead, zinc and copper with AAS.

Channel samples are collected along sample lines perpendicular to the mineralized vein structure in exploration tunnels. Spacing between sampling lines is typically 5m along strike. Both the mineralized vein and the altered wall rocks are cut with continuous chisel chipping. Sample length ranges from 0.2m to more than 1m, depending on the width of the mineralized vein and the mineralization type. Channel samples are prepared and assayed with AAS at Silvercorp’s mine laboratory (Ying Lab) located at the mill complex in Luoning County, Henan Province, China. The Ying lab is officially accredited by the Quality and Technology Monitoring Bureau of Henan Province and is qualified to provide analytical service. The channel samples are dried, crushed and pulverized. A 200g sample of minus 160 mesh is prepared for assay. A duplicate sample of minus 1mm is made and kept at the laboratory archives. Gold is analysed by fire assay with AAS finish, and silver, lead, zinc and copper are assayed by two-acid digestion with AAS finish.

A routine quality assurance/quality control procedure is adopted at each lab to monitor the analytical quality at the lab. Certified reference materials (CRMs), pulp duplicates and blanks are inserted into each lab batch of samples. QA/QC data at the lab are attached to the assay certificates for each batch of samples.

The Company maintains its own comprehensive quality assurance and quality control program to ensure best practice in sample preparation and analysis of the exploration samples. Project geologists regularly insert CRM, field duplicates and blanks to each batch of core samples to monitor the sample preparation and analysis procedures at the labs. The analytical quality of the labs is further evaluated with external checks by sending about 3-5% of the pulp samples to higher level labs to check for lab bias.

Data from both the Company’s and the labs’ QA/QC programs are reviewed on a timely basis by project geologists.

Ruijin Jiang, P. Geo., reviewed the exploration data and prepared the scientific and technical information regarding exploration results contained herein. Alex Zhang, P. Geo., VP exploration of the Company, is the Qualified Person on the project as defined under National Instrument 43-101 and he has verified and approved the contents of this news release.

About Silvercorp

Silvercorp is a low-cost silver-producing Canadian mining company with multiple mines in China. The Company’s vision is to deliver shareholder value by focusing on the acquisition of under developed projects with resource potential and the ability to grow organically. For more information, please visit our website at www.silvercorp.ca.

For further information

Lorne Waldman

Senior Vice President

Silvercorp Metals Inc.

Phone: (604) 669-9397

Toll Free: 1(888) 224-1881

Email: [email protected]

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain of the statements and information in this press release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties; the sufficiency of the Company’s capital to finance the Company’s operations; estimates of the Company’s revenues and capital expenditures; estimated production from the Company’s mines in the Ying Mining District; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the Company’s operations; and access to and availability of funding for future construction, use of proceeds from any financing and development of the Company’s properties.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licenses; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China and Canada; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; and bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended March 31, 2015 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.