VANCOUVER, British Columbia – June 1, 2021 – Silvercorp Metals Inc. (“Silvercorp” or the “Company”) (TSX: SVM) (NYSE American: SVM) is pleased to report results from its 2021 exploration programs at the TLP mine, Ying Mining District, Henan Province, China. Extensive exploration drilling and tunneling are ongoing at the TLP mine, and all other mines at the Ying Mining District.

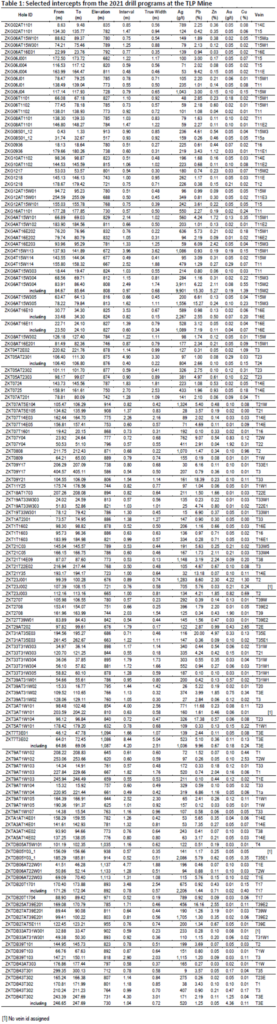

From October 1, 2020 to May 31, 2021, 34,546 metres (“m”) from a total of 196 diamond drill holes, including 161 underground holes and 35 surface holes, were completed at the TLP mine. Assay results for 193 holes have been received, with 108 holes intercepting mineralization. Currently, 13 rigs are drilling at the TLP mine.

Drilling Intersected High-Grade Veins in the Production Areas

The diamond drilling programs at the TLP mine targeted resource blocks of known silver-lead-zinc veins in the production areas that were missed by limited prior drilling and drifting tunnels, as a result of changes in the dip and pinch-swelling of the pay-zones in the veins. Since access tunnels are already in place, any discovered high-grade blocks can quickly be converted to reserves and mined.

The high-grade intercepts for this period are associated with parallel veins T15W, T15W1, T15W2, and T15W3. Other veins include T16E, T2, T2W, T3, T16E, T11, T1, T1a, T22, T23, T24, T33 and T35E1. Highlight of high-grade intercepts in the TLP production area:

- Hole ZKG6AT15W304 intersected a 2.49 m interval (1.74 m true width) of vein T15W2 grading 3,911 grams per tonne (“g/t”) silver (“Ag”), 6.22% lead (“Pb”), 2.11% zinc (“Zn”), 0.08 g/t gold (“Au”) and 0.55% copper (“Cu”) at the 808 m elevation, which includes a 0.97 m interval (0.68 m true width) grading 9,901 g/t Ag, 15.30% Pb, 5.27% Zn, 0.19 g/t Au, and 1.39% Cu;

- Hole ZKG6AT15W305 intersected a 1.62 m interval (1.11 m true width) of vein T15W3 grading 1,556 g/t Ag, 15.27% Pb, 0.24% Zn, 0.10 g/t Au, and 0.23% Cu at the 813 m elevation;

- Hole ZKT3AT1W101 intersected a 4.00 m interval (2.56 m true width) of vein T23 grading 771 g/t Ag, 11.68% Pb, 0.23% Zn, 0.08 g/t Au, and 0.11% Cu at the 854 m elevation;

- Hole ZKT7T3E02 intersected an 8.44 m interval (5.04 m true width) of vein T3E grading 523 g/t Ag, 5.10% Pb, 0.36% Zn, 0.11 g/t Au, and 0.13% Cu at the 1,086 m elevation, which includes a 4.20 m interval (2.51 m true width) grading 1,036 g/t Ag, 9.96% Pb, 0.67% Zn, 0.18 g/t Au, and 0.24% Cu at the 1,087 m elevation;

- Hole ZKT23J001 intersected a 0.89 m interval (0.74 m true width) of vein T2 grading 1,283 g/t Ag, 8.60% Pb, 2.30% Zn, 4.22 g/t Au, and 1.30% Cu at the 676 m elevation;

- Hole ZKTDB39T103 intersected a 2.90 m interval (2.03 m true width) of vein T3 grading 1,115 g/t Ag, 1.20% Pb, 0.09% Zn, 0.08 g/t Au, and 0.11% Cu at the 818 m elevation;

- Hole ZKTDB05Y03_1 intersected a 0.52 m interval (0.51 m true width) of vein T35E1 grading 2,086 g/t Ag, 5.79% Pb, 0.62% Zn, 0.05 g/t Au, and 0.35% Cu at the 914 m elevation; and

- Hole ZKTDB43T302 intersected a 1.04 m interval (0.72 m true width) of vein T3E grading 520 g/t Ag, 1.25% Pb, 0.05% Zn, 4.36 g/t Au, and 0.11% Cu at the 730 m elevation.

Surface and Underground Drilling Outside the TLP Mine’s Resource Area

Exploratory surface drilling in the east and south sides of the resource area in the TLP mine discovered high-grade silver-lead-zinc mineralization at higher elevations. These intercepts of veins T39E2, T17 and T38 are expected to expand the resources in these areas.

- Hole ZKG4T15W113 intersected a 3.96 m interval (3.62 m true width) of vein T15W1 grading 1,086 g/t Ag, 0.93% Pb, 0.19% Zn, 0.19 g/t Au, and 0.15% Cu at the 672 m elevation;

- Hole ZKTDB20T1701 intersected a 3.48 m interval from 170.40 m to 173.88 m (2.54 m true width) of vein T17, grading 675 g/t Ag, 0.92% Pb, 0.43% Zn, 0.01 g/t Au, and 0.15% Cu at the 893 m elevation, which includes a 0.78 m interval from 171.26 m to 172.04 m (0.57 m true width) grading 2,206 g/t Ag, 1.44% Pb, 0.71% Zn, 0.02 g/t Au, and 0.40% Cu at the 892 m elevation;

- Hole ZKTDB27AT39E201 intersected a 0.81 m interval from 99.41 m to 100.22 m (0.56 m true width) of vein T39E2 grading 1,705 g/t Ag, 1.3% Pb, 0.35% Zn, 0.02% Au, and 0.06% Cu at the 803 m elevation; and

- Hole ZKTDB25AT39E201 intersected a 1.71 m interval from 169.08 m to 170.79 m (0.46 m true width) of vein T39E2 grading 456 g/t Ag, 16.16% Pb, 2.55% Zn, 0.01% Au, and 0.11% Cu at the 785 m elevation.

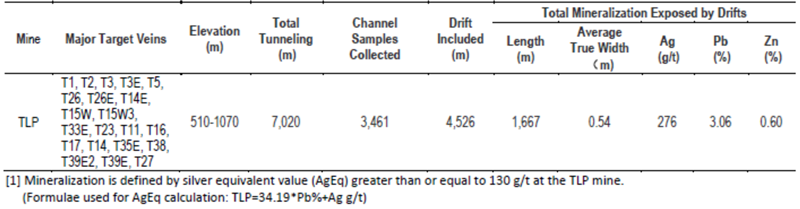

Tunneling Program at the TLP Mine

In addition to the drilling program, 4,526 m of exploration drift tunneling were developed at the TLP mine during this period. The exploration tunneling, comprised of drifting, cross-cutting and raising, was driven along and across major mineralized vein structures to upgrade the drill defined mineral resources and test for new parallel and splay structures, and are summarized in the following table.

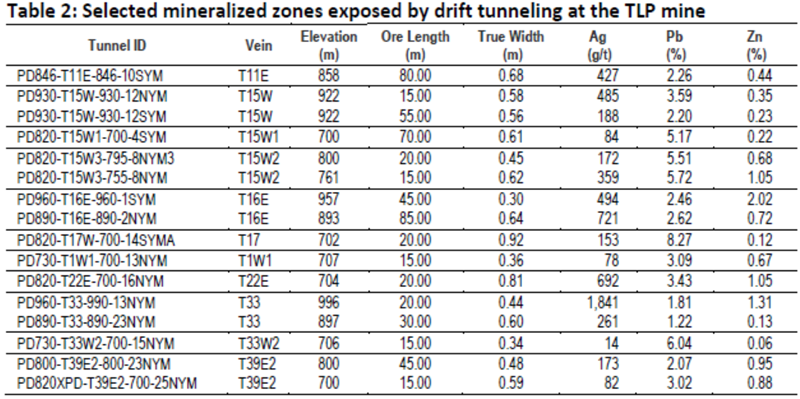

Highlights of selected mineralized zones exposed in the drift tunnels:

- Drift Tunnel PD890-T16E-890-2NYM exposed mineralization 85 m long and 0.64 m wide (true width) grading 721 g/t Ag, 2.62% Pb and 0.72% Zn within vein T16E on the 893 m level;

- Drift Tunnel PD820-T22E-700-16NYM exposed mineralization 30 m long and 0.81 m wide (true width) grading 692 g/t Ag, 3.43% Pb and 1.05% Zn within vein T22E on the 704 m level;

- Drift Tunnel PD960-T33-990-13NYM exposed mineralization 20m long and 0.44 m wide (true width) grading 1,841 g/t Ag, 1.81% Pb and 1.31% Zn within vein T33 on the 960m level; and

- Drift Tunnel PD846-T11E-846-10SYM exposed mineralization 110m long and 0.68 m wide (true width) grading 427 g/t Ag, 2.26% Pb and 0.44% Zn within vein T11E on the 858 m level.

Quality Control

Drill cores are NQ size. Drill core samples, limited by apparent mineralization contacts or shear/alteration contacts, were split into halves by saw cutting. The half cores are stored in the Company’s core shacks for future reference and checks, and the other half core samples are shipped in securely sealed bags to the Chengde Huakan 514 Geology and Minerals Test and Research Institute in Chengde, Hebei Province, China, 226 km northeast of Beijing, the Zhengzhou Nonferrous Exploration Institute Lab in Zhengzhou, Henan Province, China, and the Analytical Lab of the Inner Mongolia Geological Exploration Bureau in Hohhot, Inner Mongolia, China. All the three labs are ISO9000 certified analytical labs. For analysis, the sample is dried and crushed to minus 1mm and then split to a 200-300g subsample which is further pulverized to minus 200 mesh. Two subsamples are prepared from the pulverized sample. One is digested with aqua regia for gold analysis with atomic absorption spectroscopy (AAS), and the other is digested with two-acids for analysis of silver, lead, zinc and copper with AAS.

Channel samples are collected along sample lines perpendicular to the mineralized vein structure in exploration tunnels. Spacing between sampling lines is typically 5m along strike. Both the mineralized vein and the altered wall rocks are cut by continuous chisel chipping. Sample length ranges from 0.2m to more than 1m, depending on the width of the mineralized vein and the mineralization type. Channel samples are prepared and assayed with AAS at Silvercorp’s mine laboratory (Ying Lab) located at the mill complex in Luoning County, Henan Province, China. The Ying lab is officially accredited by the Quality and Technology Monitoring Bureau of Henan Province and is qualified to provide analytical services. The channel samples are dried, crushed and pulverized. A 200g sample of minus 160 mesh is prepared for assay. A duplicate sample of minus 1mm is made and kept in the laboratory archives. Gold is analysed by fire assay with AAS finish, and silver, lead, zinc and copper are assayed by two-acid digestion with AAS finish.

A routine quality assurance/quality control (QA/QC) procedure is adopted to monitor the analytical quality at each lab. Certified reference materials (CRMs), pulp duplicates and blanks are inserted into each batch of lab samples. QA/QC data at the lab are attached to the assay certificates for each batch of samples.

The Company maintains its own comprehensive QA/QC program to ensure best practices in sample preparation and analysis of the exploration samples. Project geologists regularly insert CRM, field duplicates and blanks to each batch of 30 core samples to monitor the sample preparation and analysis procedures at the labs. The analytical quality of the labs is further evaluated with external checks by sending approximately 3-5% of the pulp samples to higher level labs to check for lab bias. Data from both the Company’s and the labs’ QA/QC programs are reviewed on a timely basis by project geologists.

Guoliang Ma, P. Geo., Manager of Exploration and Resource of the Company, is the Qualified Person for Silvercorp under NI 43-101 and has reviewed and given consent to the technical information contained in this news release.

About Silvercorp

Silvercorp is a profitable Canadian mining company producing silver, lead and zinc metals in concentrates from mines in China. The Company’s goal is to continuously create healthy returns to shareholders through efficient management, organic growth and the acquisition of profitable projects. Silvercorp balances profitability, social and environmental relationships, employees’ wellbeing, and sustainable development. For more information, please visit our website at www.silvercorp.ca.

For further information

Lon Shaver

Vice President

Silvercorp Metals Inc.

Phone: (604) 669-9397

Toll Free: 1 (888) 224-1881

Email: [email protected]

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER – FORWARD LOOKING STATEMENTS

Certain of the statements and information in this press release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Forward-looking statements or information relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company’s material properties; the sufficiency of the Company’s capital to finance the Company’s operations; estimates of the Company’s revenues and capital expenditures; estimated production from the Company’s mines in the Ying Mining District; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the Company’s operations; and access to and availability of funding for future construction, use of proceeds from any financing and development of the Company’s properties.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, social and economic impacts of COVID-19; risks relating to: fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licenses; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company’s existing operations; competition; operations and political conditions; regulatory environment in China and Canada; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act; and bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company’s Annual Information Form for the year ended March 31, 2020 under the heading “Risk Factors”. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

CAUTIONARY NOTE TO US INVESTORS

The disclosure in this news release and referred to herein was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms “proven mineral reserve”, “probable mineral reserve” and “mineral reserves” used in this news release are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained in this news release providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to corresponding definitions under the CIM Definition Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this news release may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.